{Case Study}

Personal Expense Tracking - AI Agent

AI tool for smart expense tracking and financial insights.

{Case Study}

AI tool for smart expense tracking and financial insights.

Company: Finly

Timeline: 3 Months

When: 2024

Category:

Mobile Application

Download:

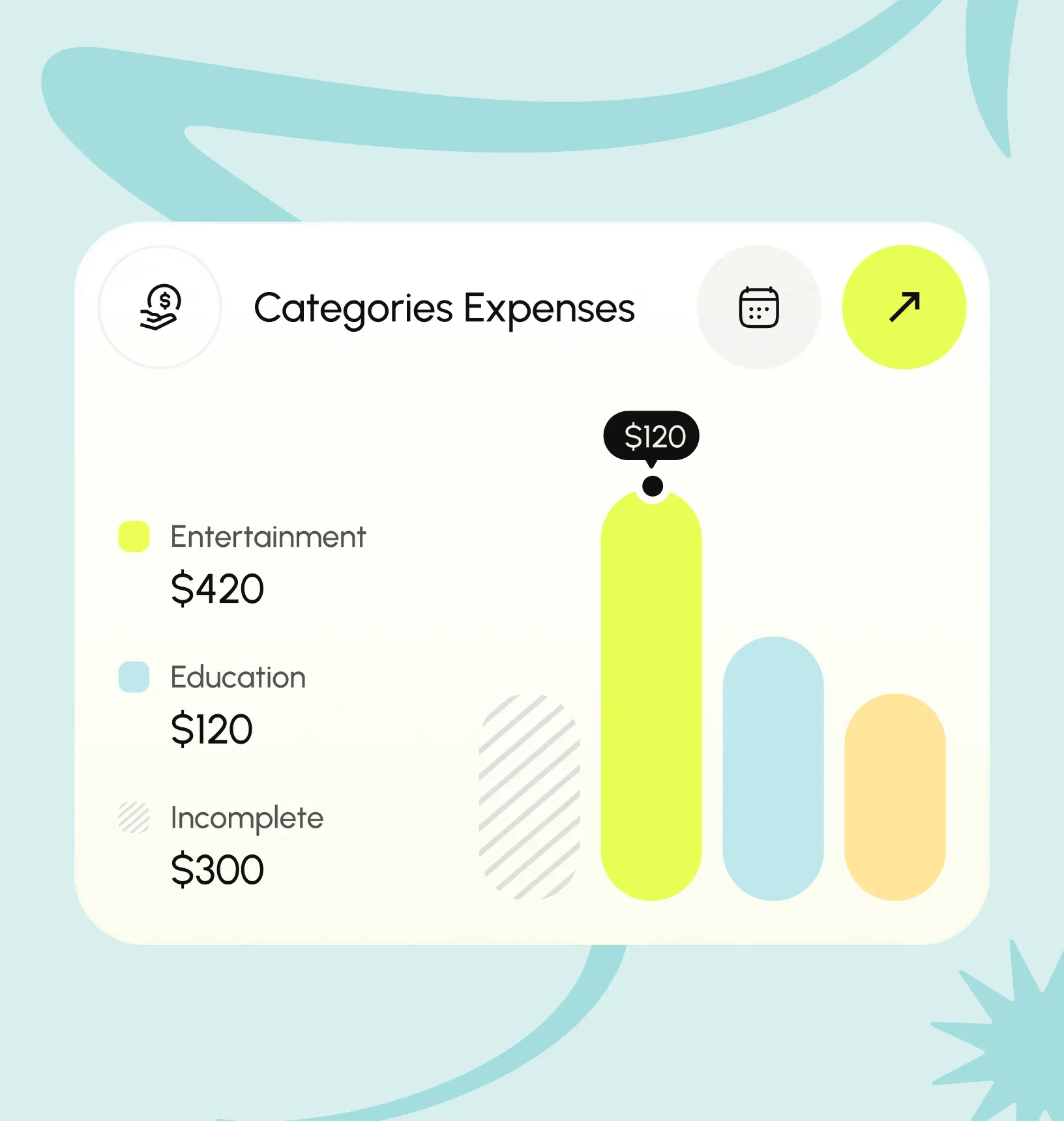

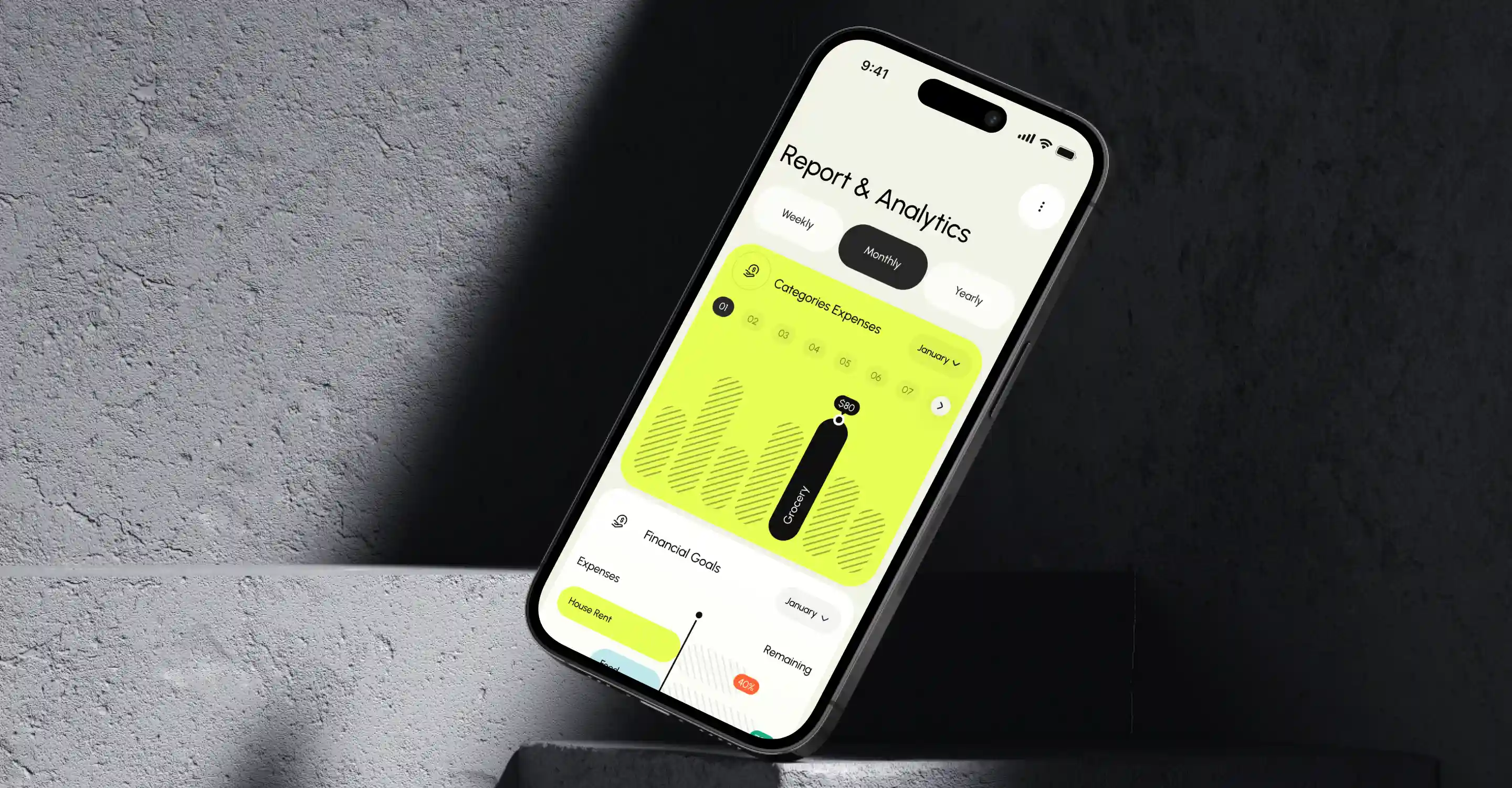

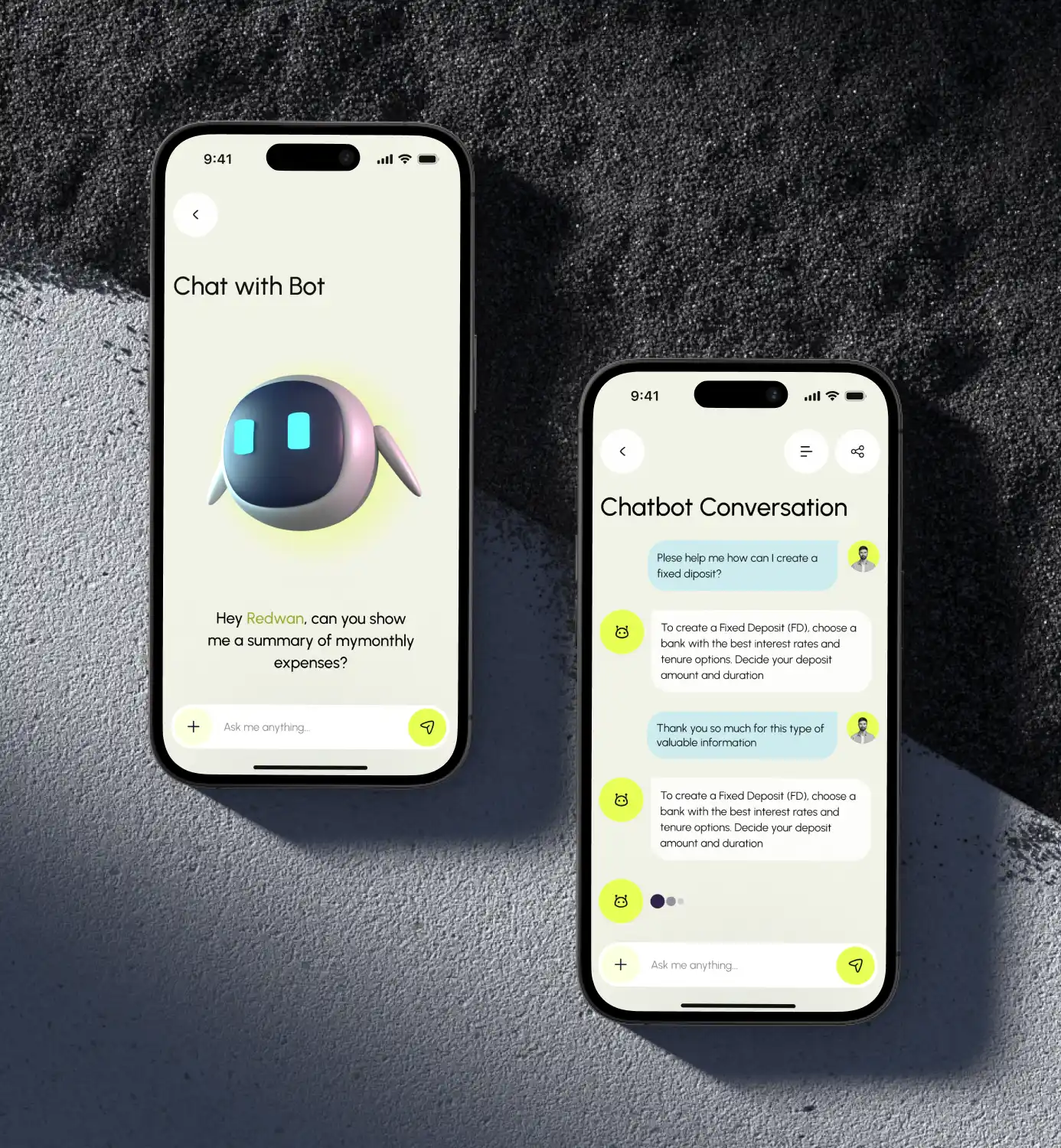

Finly is an AI-powered financial companion designed to simplify personal money management for users of all financial literacy levels. By leveraging intuitive AI tools, Finly helps users track expenses, set budgets, and receive personalized financial insights, making money management approachable and stress-free. Our goal was to create a mobile app that transforms complex financial data into actionable, user-friendly guidance, empowering users to take control of their finances with confidence.

"Working with Potential was a game-changer for us. The impact has been immediate and substantial—saving us $30,000 a month in operational costs. This launch has transformed the way we operate, making our processes more efficient and streamlined than ever before.

I’m incredibly proud of the entire team for their hard work and dedication in reaching this milestone.

A big thank you to POTENTIAL INC. for their outstanding support."

Founder of Finly

Mobile Application

Web Application

Mobile Application

Web Application